Love mobile banking? Well, it certainly helps you a lot. Thanks to it, you can do any financial transaction 24/7. Anytime. Anywhere. With mobile banking, you don’t need to go to the bank anymore. Almost everything can be done from your mobile device. That’s what we call an invention! But, have you ever thought about its security? Do you know that someone may just watching your transactions?

Many people are not aware about mobile banking security. Just because it is made by our bank, doesn’t mean it’s completely safe. Mobile banking is as vulnerable as any mobile application. Anyone can hack it.

That’s the problem. That’s what we choose to ignore. But, now let’s move forward. Let’s find out how we can improve your mobile banking experience. Let’s find out how to make mobile banking safer than ever.

Making Secure Mobile Banking Possible

Say goodbye to Wi-Fi hotspot

Still using public Wi-Fi hotspot for your mobile banking? Read these facts first:

- Public Wi-Fi hotspots are not password protected. This makes them the most vulnerable target to hackers.

- Some public Wi-Fi hotspots allow the owner to monitor your activity.

- Many public Wi-Fi routers can extract your personal information. That includes your ID, account credentials, traffic, and many more.

Always sign out

All mobile banking applications are made to log out automatically. It is a standar procedure meant to keep hijackers away. So, in case you forget, you’ll be automatically logged out from the app. But this scenario only works if you still hold the device. If you somehow handed over your device while still logged in, that person can do everything with your account.

So, don’t forget to sign out.

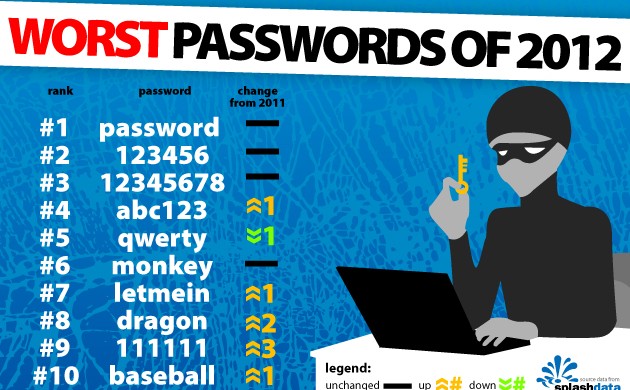

Cautiously choose your username and password

Your username and password are not just keys to your mobile banking. They are also your first defense against cyber crimes. The more complex your keys, they would be more difficult to guess. It’s kind of annoying when there are still so many people using generic passwords for their mobile banking. Still, they blame banks for their mistake.

Of course, generic passwords are easier to remember than complex one. But, think about this. Do you think that easiness worth for your information? Everything you’ve gained until now, do you want to just hand them over to those hijackers because you hate spending time looking for a better password?

Also, with the help of technology, it’s not difficult to create strong credentials. There are plenty of apps that can help you generate strong passwords (and username).

It is also worth to consider 2-step verification. This will make your account more difficult to breach.

Always update your operating system

Cyber crime evolves. Not even a single day it passes without finding out a better way to attack us. Even if you got the safest mobile banking on your device, it will be useless if you don’t regularly update your OS. It will be like running a smart home on an old computer.

New OS usually comes with security updates. These updates will fix any security hole in the previous version. Get these updates once they’re available. Only after then, you can truly enjoy mobile banking.

Encrypt your connection

With encryption, you’re the only one who knows everything you do online. No one else. Everything is kept secret. A top secret with you holding its only key.

That’s what you want for a secure mobile banking, isn’t it?

Avoid clicking suspicious links

Remember your bank email address carefully. Typically, all banks have unique email address for their mobile banking. Leave any email from unknown senders. Do not open it. Do not download the attachment. Do not click the link(s) inside it. Cyber criminals will try to convince you with fake emails. They will use email address similar to your bank. So, carefully remember the official email address. If you’re not certain about the email, contact your bank directly. Ask them about the matter. Only after they confirmed it, you can open the email.

Set up alert notifications

Ask your bank if they provide alert notification in their mobile banking. With this feature, you can monitor all your transactions. When a suspicious transaction is detected, you will get a notification. All notifications will be sent directly to your device. If this feature is not available, regularly check your banking activities. Check for possible suspicious activities.

Don’t let your guard down.

English

English

German

German Dutch

Dutch Thai

Thai Chinese

Chinese

Anil Surma

Thank you for sharing such great information. It is informative,For More Details Visit: http://www.idbi.com/idbi-bank-mobile-banking.asp

brian

Thank you, Anil. We hope this information helps your bank’s customers to be safe on the web.